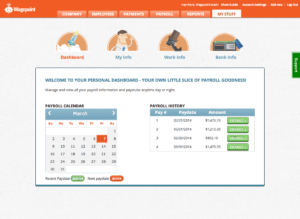

Our small business payroll software makes it easy to pay everyone and stay on top of your payroll taxes too.

Trusted by entrepreneurs and small businesses across North America

Stop worrying about missing tax payments and late reporting. Send money directly to your employees’ bank accounts. Give everyone online access to their pay details. Generate and submit your Records of Employment (ROEs).

Automate withholding, contributions and compliance for Federal and provincial/territorial income tax, Employment Insurance/Québec Parental Insurance Plan (EI/QPIP), Canada Pension Plan/Québec Pension Plan (CPP/QPP), Provincial and territorial taxes, Year-end T4/T4As and reporting.

Lower the risk of costly mistakes by automatically calculating incomes, deductions, paid time off, workers’ Compensation (WCB/WSIB), employer Health Tax/Health Services Fund (EHT/HSF).

Designed to be easy to use with built-in tips and guides, clever add-ons and integrations, world-class support.

Contact us today to see how we can help you.