Weekly Business Update – 10th November 2023

Welcome to our Weekly Digest – stay in the know with some recent news updates relevant to business and the economy.

Prolonged High Interest Rates: How They Affect Your Investment Portfolio

Higher interest rates have had a significant impact on the portfolios of numerous Canadians throughout this year, affecting individual investors, businesses, institutions, and the broader economy. As borrowing costs rise, the affordability of loans diminishes, prompting individuals to rethink their investment strategies and potentially adjust their portfolios accordingly. The performance of various assets, such as stocks, bonds, and real estate, has been noticeably influenced by the prevailing interest rate environment.

The Bank of Canada’s role in setting the benchmark interest rate holds immense significance in shaping the trajectory of the country’s financial markets. As market participants eagerly anticipate the central bank’s next move, fresh expectations regarding the future rate path have emerged, creating an atmosphere of anticipation and uncertainty. These evolving expectations have the potential to trigger significant shifts in market sentiment and investor behavior.

A dovish stance from the Bank of Canada, indicating potential interest rate decreases, could instill optimism among investors, leading to increased demand for riskier assets like stocks and potentially lowering bond yields, making fixed-income investments more attractive. Conversely, a more hawkish approach, implying future interest rate hikes, could dampen market sentiment and lead to a more cautious investment environment. Investors might opt for safer assets, causing potential declines in equity markets, while bond yields rise, impacting the attractiveness of fixed-income investments.

The interplay between the Bank of Canada’s rate decisions and market reactions is complex and multifaceted, influenced by economic indicators such as inflation, employment data, and GDP growth. These indicators shape the central bank’s stance and, in turn, influence market expectations, creating a delicate balance between economic fundamentals and investor sentiment. Monitoring the Bank of Canada’s rate path is essential for investors, businesses, and individuals to stay informed and adjust strategies accordingly, enabling them to capitalize on opportunities or mitigate potential risks arising from shifts in interest rates.

Canada’s Immigration Levels Plateau: A Positive Move, According to Economists

Prime Minister Justin Trudeau’s government’s decision to not increase its immigration targets this week is being described as a step in the right direction by economists. However, they are urging Ottawa to provide more insight on how they plan to effectively deal with the steep rise in the number of temporary residents. While the government’s decision to maintain current immigration targets may be seen as a prudent move, there is growing concern about the surge in temporary residents.

Prime Minister Justin Trudeau’s government’s decision to not increase its immigration targets this week is being described as a step in the right direction by economists. However, they are urging Ottawa to provide more insight on how they plan to effectively deal with the steep rise in the number of temporary residents. While the government’s decision to maintain current immigration targets may be seen as a prudent move, there is growing concern about the surge in temporary residents.

These temporary residents, which include international students, temporary foreign workers, and visitors, have been steadily increasing in numbers over the past few years. Economists emphasize the need for a comprehensive strategy to address this issue. It is crucial for the government to outline measures that will ensure the smooth integration of temporary residents into Canadian society and economy. Without a clear plan, there is a risk of potential strain on public services, housing, and job markets.

Experts believe that Ottawa should focus on creating pathways for temporary residents to transition into permanent residents. This would not only provide stability to these individuals but also help address the labor market needs of various sectors in Canada. By facilitating their integration into the country, the government can harness the skills and talents of temporary residents, ultimately benefiting the economy in the long run.

Economists stress the importance of collecting accurate data on temporary residents to better understand their impact on the Canadian economy. This data will enable policymakers to make informed decisions and develop targeted policies that address the specific challenges faced by this group.

Canada’s Rental Prices Reach All-Time High in October 2023

The latest report from a prominent Canadian rental listings website has revealed that rental prices in Canada have reached an unprecedented all-time high, averaging $2,149 per month. This alarming data sheds light on the challenges faced by individuals seeking accommodation across the country, as soaring rental costs create financial strain for many prospective tenants.

The latest report from a prominent Canadian rental listings website has revealed that rental prices in Canada have reached an unprecedented all-time high, averaging $2,149 per month. This alarming data sheds light on the challenges faced by individuals seeking accommodation across the country, as soaring rental costs create financial strain for many prospective tenants.

This surge in rental prices reflects the increasing demand for housing and a scarcity of available units, resulting in a fiercely competitive rental market. Landlords and property owners are capitalizing on this situation, exacerbating tenants’ financial burdens.

This rental crisis is not limited to major cities like Toronto, Vancouver, and Montreal; it permeates throughout the nation, affecting smaller cities and towns as well. The implications of these rising rental prices extend beyond tenants’ financial strain, impacting their ability to save, invest, and meet essential needs. The crisis also affects local businesses and overall consumer confidence as discretionary spending decreases.

Concerns have arisen about housing affordability and accessibility in Canada. It highlights the need for government intervention, including increasing the supply of affordable housing, implementing rent control policies, and providing financial assistance to those struggling with high rental costs. Addressing this issue is crucial to alleviate the burden on vulnerable populations and reduce social inequality in the face of this rental price surge.

Companies Eager to Raise Prices, Fueling Inflation Concerns

The recent surge in inflation rates has reached alarming levels, prompting corporations to take advantage of the situation by increasing their prices. Central banks, including the Bank of Canada, are now acknowledging and addressing this growing trend. For consumers who have recently visited grocery stores, car dealerships, or refueled their vehicles, the impact of these price hikes has become increasingly evident.

The recent surge in inflation rates has reached alarming levels, prompting corporations to take advantage of the situation by increasing their prices. Central banks, including the Bank of Canada, are now acknowledging and addressing this growing trend. For consumers who have recently visited grocery stores, car dealerships, or refueled their vehicles, the impact of these price hikes has become increasingly evident.

The Bank of Canada faces the challenging task of taming this economic force as it strives to regain control over inflation. High inflation has given corporations an ideal opportunity to justify price increases and protect their profit margins. Rising costs and fluctuating market conditions have led businesses to safeguard their financial stability by adjusting their prices.

A visit to the grocery store highlights the impact of inflation on everyday essentials, with food prices experiencing significant spikes. This has left consumers facing higher bills and reduced purchasing power for basic necessities. Similarly, the automotive industry has raised prices due to rising production costs and component shortages, making new vehicles less affordable for many potential buyers.

One of the most noticeable impacts of inflation is the rising price of fuel, which burdens individuals and businesses alike. This increase not only affects transportation costs but also leads to higher prices for goods and services across various sectors, impacting the overall economy. In response, the Bank of Canada has intensified efforts to stabilize the economy, using monetary policy tools to curb inflationary pressures and restore price stability. Balancing the needs of businesses, consumers, and economic stability is a complex challenge, but the central bank is committed to addressing this issue and fostering a more sustainable economic environment.

Canada’s Stagnating Economy: No Growth Since May, Raising Recession Concerns

Canada’s economy is undeniably showing signs of a slowdown. After a contraction in June, the value of all traded goods and services essentially remained stagnant in the following months of July and August, with September expected to continue the trend. According to Statistics Canada’s latest report, the country’s gross domestic product (GDP) experienced a standstill in August.

Canada’s economy is undeniably showing signs of a slowdown. After a contraction in June, the value of all traded goods and services essentially remained stagnant in the following months of July and August, with September expected to continue the trend. According to Statistics Canada’s latest report, the country’s gross domestic product (GDP) experienced a standstill in August.

While the service sector managed to see marginal expansion, this growth was overshadowed by a contraction in output from goods-producing industries. The recent data highlights a concerning trend of economic deceleration. Following the initial contraction in June, the Canadian economy struggled to regain momentum, with stagnant GDP figures in July and August.

The service sector’s modest growth was insufficient to offset the decline in production from goods-producing industries, leaving the overall economic performance in question. The situation has raised concerns about the health of Canada’s economy, with experts closely monitoring the monthly GDP numbers.

The standstill in economic growth since June warrants attention from policymakers and economists as they seek ways to stimulate economic activity and address the challenges faced by both the service and goods-producing sectors. As September’s data looms, it remains to be seen whether the trend of economic stagnation will persist or if measures will be taken to reinvigorate growth and prevent a prolonged slowdown in Canada’s economy.

October’s Disappointing Job Market: Minimal Gains in Employment

The latest job and Gross Domestic Product (GDP) numbers in Canada suggest a potential weakening in the country’s economy, prompting financial analyst Robert Levy to explore their implications. Job numbers, a crucial indicator of economic health, reveal a concerning trend of job losses and lackluster employment growth. This suggests that businesses may be facing challenges, leading to reduced hiring and even downsizing, with possible ripple effects on consumer spending, investments, and overall economic activity.

The latest job and Gross Domestic Product (GDP) numbers in Canada suggest a potential weakening in the country’s economy, prompting financial analyst Robert Levy to explore their implications. Job numbers, a crucial indicator of economic health, reveal a concerning trend of job losses and lackluster employment growth. This suggests that businesses may be facing challenges, leading to reduced hiring and even downsizing, with possible ripple effects on consumer spending, investments, and overall economic activity.

Simultaneously, GDP figures reflect a sluggish growth rate, signaling difficulties in various sectors of the Canadian economy. Factors like global economic uncertainties, trade disputes, or domestic policy issues may contribute to this slowdown. Regardless of the causes, a faltering GDP growth rate implies reduced productivity, decreased business investments, and potentially lower living standards for Canadians.

In this context, financial analyst Robert Levy emphasizes the impact of upcoming mortgage renewals on the situation. Mortgage renewals involve renegotiating terms and interest rates on existing mortgages. Given the current economic climate marked by job losses and sluggish GDP growth, many Canadians may face financial strain as mortgage renewals approach. Securing favorable terms may be challenging, and there is a risk of mortgage default.

The combination of a weakening economy, reduced job opportunities, and uncertain GDP growth rates creates a precarious environment for mortgage renewals. With diminished financial stability, individuals may struggle to meet renewed mortgage terms, potentially leading to mortgage delinquencies and foreclosures. These events can further destabilize the housing market and place additional stress on the overall economy.

Economic Uncertainty: Rate Hikes in Doubt as Recession Fears Grow with GDP Numbers

Preliminary data from Statistics Canada indicates that the Canadian economy may be entering a technical recession due to the adverse impact of increasing interest rates on consumer spending. As interest rates continue to rise, they are putting significant strain on consumers’ purchasing power, making it difficult for them to contribute to economic growth through their spending habits. The potential implications of this technical recession are far-reaching and warrant close attention.

Preliminary data from Statistics Canada indicates that the Canadian economy may be entering a technical recession due to the adverse impact of increasing interest rates on consumer spending. As interest rates continue to rise, they are putting significant strain on consumers’ purchasing power, making it difficult for them to contribute to economic growth through their spending habits. The potential implications of this technical recession are far-reaching and warrant close attention.

Consumer spending is a cornerstone of economic activity, directly influencing industries like retail, hospitality, and entertainment, while also affecting sectors such as manufacturing, construction, and services. The escalation of interest rates has led to higher borrowing costs for individuals and households, making it challenging for them to afford major expenses like homes, cars, or luxury goods. With limited disposable income, consumers are prioritizing essential expenditures, leading to reduced discretionary spending.

Consequently, businesses across various sectors are experiencing declining demand, potentially resulting in lower revenues and job losses. The repercussions of this potential recession extend beyond Canada’s borders. As a major trading nation heavily reliant on exports for economic growth, a domestic slowdown in consumer spending can negatively impact international trade. Reduced demand for Canadian goods and services can affect export volumes and strain the country’s trade balance.

To address these challenges, government and policymakers must consider measures to mitigate the potential recession’s impact. Central banks may need to reevaluate interest rate policies to strike a balance between controlling inflation and maintaining manageable borrowing costs for consumers. Additionally, deploying fiscal stimulus packages aimed at boosting consumer spending and business investment could provide a much-needed boost to the economy. Close monitoring and analysis of economic indicators will be crucial in determining whether the current slowdown constitutes a technical recession or a temporary setback, allowing for swift and effective measures to support the Canadian economy.

Canadian Business Insolvencies Soar by Nearly 42% Compared to Last Year

Business insolvencies in Canada have surged dramatically, with data from the Office of the Superintendent of Bankruptcy revealing a concerning trend. In the third quarter, insolvencies saw a staggering increase of 41.8% compared to the same period the previous year, surpassing pre-pandemic levels. During this quarter, a total of 1,129 businesses filed for bankruptcy or proposal, marking a notable 3.6% increase from the preceding quarter. This sharp rise in business insolvencies is a clear reflection of the formidable challenges and economic pressures faced by Canadian enterprises amid the ongoing global pandemic.

Business insolvencies in Canada have surged dramatically, with data from the Office of the Superintendent of Bankruptcy revealing a concerning trend. In the third quarter, insolvencies saw a staggering increase of 41.8% compared to the same period the previous year, surpassing pre-pandemic levels. During this quarter, a total of 1,129 businesses filed for bankruptcy or proposal, marking a notable 3.6% increase from the preceding quarter. This sharp rise in business insolvencies is a clear reflection of the formidable challenges and economic pressures faced by Canadian enterprises amid the ongoing global pandemic.

Businesses are grappling with prolonged periods of uncertainty, disrupted supply chains, and reduced consumer demand, pushing many to the brink of financial collapse. The implications of these insolvencies extend far beyond the affected businesses, impacting the broader economy with job losses, reduced tax revenues, and an overall economic slowdown. This surge in business closures raises concerns about the Canadian economy, which had been showing signs of recovery in recent months.

Certain sectors, notably service-based industries like hospitality, travel, and retail, have borne the brunt of this wave of insolvencies. These businesses, already burdened with mounting debts and limited cash flow, now face an uphill battle for survival. As the uncertain trajectory of the pandemic continues, businesses must navigate a landscape filled with ambiguity, necessitating innovative strategies and adaptability to thrive in changing market conditions.

The surge in business insolvencies underscores the fragility of the Canadian economy in the face of unprecedented challenges. Urgent collective efforts from all stakeholders are required to support struggling businesses, protect jobs, and rekindle economic growth. Only through coordinated actions can Canada mitigate the enduring impact of these insolvencies and chart a path towards a more resilient and prosperous future.

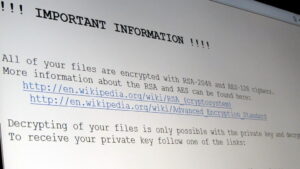

48 Governments Unite to Take a Stand Against Ransomware Extortion

Forty-eight nations, including Canada and the United States, have united in a strong stance against the growing threat of ransomware attacks. This resolute commitment was formalized at the third annual meeting of the International Counter Ransomware Initiative (CRI) held in Washington, D.C. The meeting provided a crucial platform for global leaders and cybersecurity experts to collaborate and address the escalating menace of ransomware. With participants from diverse continents, it underscored the pressing need for international cooperation to combat this dangerous cyber threat.

Forty-eight nations, including Canada and the United States, have united in a strong stance against the growing threat of ransomware attacks. This resolute commitment was formalized at the third annual meeting of the International Counter Ransomware Initiative (CRI) held in Washington, D.C. The meeting provided a crucial platform for global leaders and cybersecurity experts to collaborate and address the escalating menace of ransomware. With participants from diverse continents, it underscored the pressing need for international cooperation to combat this dangerous cyber threat.

During the deliberations, representatives from these forty-eight countries engaged in comprehensive discussions, sharing best practices and successful strategies to mitigate the devastating impact of ransomware attacks. The collective wisdom gathered from these exchanges laid the groundwork for a unified approach to safeguard national interests and protect critical infrastructures from ransomware’s perils.

At the culmination of this landmark meeting, participants solemnly vowed to resist the temptation of capitulating to ransomware perpetrators. Recognizing the detrimental consequences of yielding to these demands, the countries affirmed their dedication to fostering a global environment where cybercriminals are unequivocally deterred and brought to justice.

The International Counter Ransomware Initiative (CRI) emerged as a beacon of hope, fostering a collaborative ecosystem for governments, organizations, and cybersecurity experts to pool their resources and expertise. By forging robust partnerships, sharing intelligence, and implementing proactive measures, the CRI strives to fortify the collective resilience of nations against the ever-evolving ransomware landscape. The resounding commitment made by these forty-eight countries, including Canada and the U.S., sends a powerful message to ransomware actors that their nefarious activities will be met with unwavering resolve. As the world grapples with the increasing sophistication of cyber threats, the unified front showcased at the CRI meeting serves as a testament to the global community’s determination to safeguard the digital realm and protect the interests of individuals, businesses, and governments alike.

Get in touch

Got a thought or question about your business?