Three Ways To Speed Up Invoicing

In the world of business, time is not just money; it’s the heartbeat of success. Picture this: you’ve delivered top-notch products or services, but your invoicing process feels like it’s stuck in a time warp, causing payment delays and headaches. Fret not! We’re about to unveil three turbocharged strategies that will supercharge your invoicing process, transforming it from a sluggish chore into a well-oiled payment machine. Say goodbye to invoicing woes and hello to a future where your cash flow flows freely, thanks to these simple yet eye-catching solutions.

1. Automate Invoicing Tasks:

Automation is the cornerstone of modern business efficiency, and it plays a pivotal role in accelerating the invoicing process. Here’s a more detailed breakdown of how to implement automation effectively:

Automation is the cornerstone of modern business efficiency, and it plays a pivotal role in accelerating the invoicing process. Here’s a more detailed breakdown of how to implement automation effectively:

a. Choose the Right Invoicing Software: Selecting the appropriate invoicing software is crucial. Look for a solution that aligns with your business needs and provides features such as customizable invoice templates, client management, and seamless integration with your accounting system. By using specialized software, you can reduce the time spent on manual data entry and minimize the chances of errors in your invoices.

b. Set Up Automated Reminders: Late payments are a common headache for businesses. Automating payment reminders can significantly improve your cash flow. Most invoicing software allows you to schedule automated reminders to be sent to clients with overdue invoices. These gentle nudges can prompt clients to settle their bills promptly, reducing the need for follow-up calls or emails.

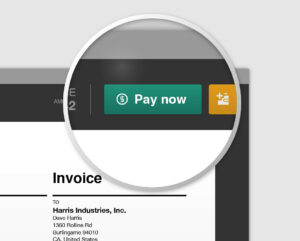

c. Integrate with Payment Gateways: Offering online payment options within your invoices is a convenient way to speed up payments. Modern invoicing software often integrates with popular payment gateways, allowing your clients to pay instantly with credit cards or other digital payment methods. This minimizes the friction in the payment process and ensures faster transactions.

d. Utilize OCR Technology: For businesses that still deal with paper invoices, Optical Character Recognition (OCR) technology is a game-changer. OCR can scan and extract data from physical invoices, converting them into digital formats that can be easily processed and stored. This eliminates the need for manual data entry, reduces the risk of errors, and accelerates the overall invoicing process.

2. Standardize and Simplify Invoice Templates:

The design and content of your invoice templates play a vital role in the efficiency of your invoicing process. Let’s explore this further:

The design and content of your invoice templates play a vital role in the efficiency of your invoicing process. Let’s explore this further:

a. Include Essential Details: Your invoices should include all the necessary information for clarity and compliance. This includes your business name, contact details, client information (name and address), a comprehensive description of the products or services provided, payment terms (due date and method), and a transparent breakdown of costs, including taxes and discounts. By standardizing this information on your templates, you ensure consistency and reduce the likelihood of errors or disputes.

b. Use a Professional Design: A professionally designed invoice not only looks impressive but also reflects positively on your business’s image. A clean and well-structured layout with your company logo and branding elements conveys a sense of professionalism and reliability to your clients. It also makes it easier for clients to identify your invoices in their inbox or mailbox, reducing the risk of them getting lost or overlooked.

c. Save Templates for Reuse: To further expedite the invoicing process, save your standardized templates within your invoicing software. This allows you to quickly generate invoices for recurring clients or projects without having to recreate them from scratch each time. The ability to populate templates with client-specific information and line items simplifies the process, saving valuable time.

3. Implement Efficient Payment Tracking:

Tracking payments effectively is essential for maintaining financial control and minimizing disruptions to your cash flow. Here’s how you can establish efficient payment tracking practices:

a. Use Accounting Software: Investing in accounting software that includes invoicing and payment tracking features is highly beneficial. These integrated systems allow you to monitor the status of each invoice, record payments, and generate financial reports seamlessly. You can easily see which invoices are outstanding, which are overdue, and which have been paid, enabling you to take appropriate action.

b. Regularly Reconcile Accounts: Periodic reconciliation of your accounts ensures that payments received match the invoices issued. Reconciliation identifies any discrepancies or inconsistencies that may require immediate attention. By promptly addressing payment issues, you can maintain accurate financial records and minimize the risk of financial discrepancies affecting your business.

c. Implement a Systematic Filing Method: Efficient document management is vital for easy reference and quick retrieval of invoices and related documents. Whether you maintain digital records or physical files, a logical and systematic filing method is essential. Organize invoices chronologically or by client/project to facilitate easy access. Efficient document management not only speeds up payment tracking but also enhances overall business organization.

Final Thoughts

Invoices need not be the bane of your business existence. By automating tasks, creating slick templates, and mastering payment tracking, you’ve armed yourself with the ultimate invoicing arsenal. Imagine the hours saved, the stress reduced, and the smoother financial sailing ahead. As you apply these straightforward strategies, you’re not just speeding up invoicing; you’re accelerating your path to financial success. So, take charge, put these tricks to work, and watch your invoicing process become the engine that drives your business forward. Get ready to see your business thrive, one invoice at a time!

Avail yourself of a personal consultation with our expert, Subhash Sharma, who will address your specific challenges and provide personalized solutions. Contact us today!

Calling all ambitious entrepreneurs and business owners! If you’re looking to take your profits to new heights, we’ve got the perfect solution for you. Our exclusive course below is designed to empower you with the essential strategies and techniques to unlock your business’s full potential!

Enter your details below and sign up to our course, which also includes FREE template to help you plan your strategy.